Pricing

- Free

- $60/month (Researcher)

- $120/user/month (Team)

- $336/user/month (Trading Firm)

- $1,080/user/month (Institution)

Platform

- Cloud-based platform

- On-premise infrastructure option

Pros:

✅ Advanced cloud-based backtesting and live trading capabilities

✅ Supports multiple asset classes, including equities, forex, futures, and crypto

✅ Open-source LEAN engine for full customization and control

✅ Access to a large library of alternative data sources

✅ Strong community of quant traders and developers

Cons:

❌ High costs for advanced plans, limiting access for small traders

❌ Requires strong programming skills (Python/C#) to use effectively

❌ Not beginner-friendly compared to other automated trading platforms

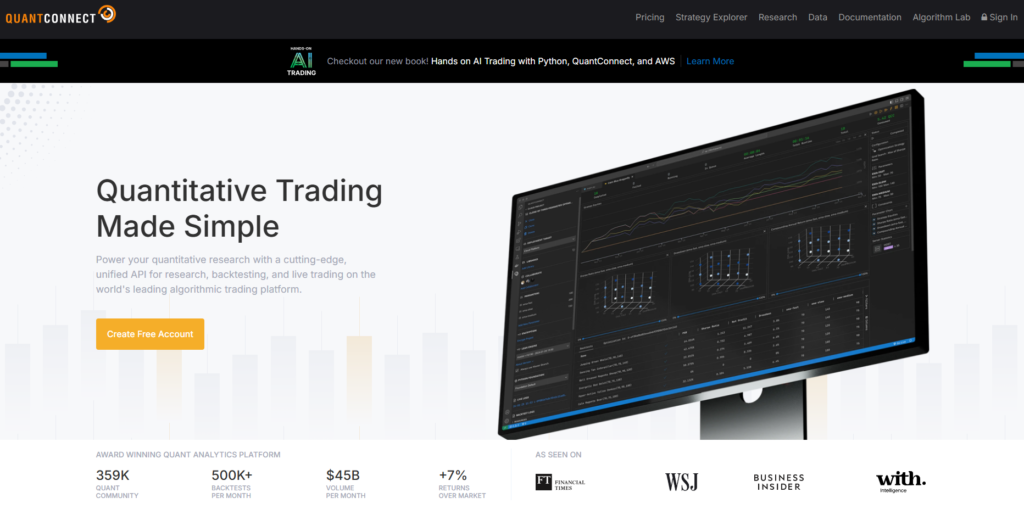

QuantConnect Review

QuantConnect is a powerful quantitative trading platform designed for self-directed investors, hedge funds, and research teams. It provides an open-source algorithmic trading engine, LEAN, allowing traders to develop, backtest, and execute trading strategies across multiple asset classes. With access to $45B in trading volume per month and over 500K backtests per month, QuantConnect has established itself as a leading platform in the quant trading space.

One of the standout features is its unified API, which connects users to major brokerages like Interactive Brokers, Binance, Coinbase, and Tradier. Unlike simpler retail trading bots, QuantConnect is geared towards developers and quants who want full control over their strategies. The LEAN engine can be run on-premise, providing complete flexibility for institutions that need custom infrastructure.

The platform’s rich dataset marketplace offers alternative data sources, including insider trading activity, analyst ratings, and macroeconomic indicators. This helps traders build more robust strategies by incorporating non-traditional signals into their models.

About QuantConnect

Founded with a vision to democratize algorithmic trading, QuantConnect aims to be the “Linux of Finance.” The company has built a massive quant community of over 358,000 users who contribute research and strategies to the platform. It has been featured in top financial publications like Financial Times, Wall Street Journal, and Business Insider.

QuantConnect’s mission is to provide an infinity cloud quant engine that integrates every asset class and brokerage into a single system. They emphasize open-source development, allowing traders and funds to modify and customize the LEAN engine to fit their needs.

Who Should Use QuantConnect?

QuantConnect is best suited for:

- Quant Traders & Developers – Those comfortable with coding (Python, C#) who want full control over their strategies.

- Hedge Funds & Institutions – Firms looking for a scalable, cloud-based infrastructure with deep backtesting capabilities.

- Data Scientists – Researchers who want access to alternative datasets and machine learning tools for trading.

Not Ideal For: Beginners or traders without programming experience, as it requires coding knowledge.

Is QuantConnect Safe?

QuantConnect prioritizes security by offering AES-256 code encryption for institutions and supports two-factor authentication (2FA). Users retain full ownership of their intellectual property (IP), ensuring that proprietary algorithms remain private.

The platform also offers on-premise trading, allowing firms to run their strategies on their own secure infrastructure rather than relying on cloud hosting.

QuantConnect Platform & Features

Cloud Research & Backtesting

QuantConnect provides high-performance backtesting using terabytes of financial data. Users can:

- Train machine learning models to optimize trading signals

- Access preprocessed alternative data linked to stocks and ETFs

- Run high-speed backtests to simulate strategy performance

Multi-Asset Trading

The platform supports trading across multiple markets:

- Equities & ETFs – US stocks since 1998

- Forex – Interbank spreads with realistic cash margin modeling

- Futures & Options – Over 70 US contracts at tick-level resolution

- Crypto – Thousands of trading pairs from major exchanges

Live Trading & Brokerage Integration

Traders can execute their strategies across multiple brokers and exchanges, including:

- Interactive Brokers – Stocks, options, futures, forex

- Binance & Coinbase – Crypto trading

- Tradier & Alpaca – US stock and options trading

LEAN Open-Source Trading Engine

The LEAN engine powers the platform, allowing full customization, backtesting, and live trading. Users can install it locally or run it in the cloud.

Build vs. Buy Cost Analysis

QuantConnect provides a Build vs. Buy calculator to help firms compare the costs of developing their own quant infrastructure versus using QuantConnect’s pre-built solutions.

Ease of Use

QuantConnect is not beginner-friendly, as it requires coding knowledge in Python or C#. However, for experienced quants and developers, the platform offers:

- Local coding environment via VSCode and CLI tools

- Cloud-based IDE for research and strategy development

- Seamless deployment from backtesting to live trading

Setting up an account requires basic registration, but to fully use the platform, traders need to configure their broker connections and coding environment.

How to Open an Account on QuantConnect

- Sign up on the QuantConnect website.

- Choose a subscription plan (Free, Researcher, Team, Trading Firm, Institution).

- Set up your development environment (Cloud IDE or Local LEAN Engine).

- Connect your brokerage for live trading.

- Start backtesting and refining your strategy.

Conclusion

QuantConnect is a top-tier algorithmic trading platform that caters to quant traders, hedge funds, and institutions. With its open-source LEAN engine, powerful backtesting tools, and access to alternative data, it offers unmatched flexibility for traders who can code their own strategies.

However, its high pricing and technical barrier make it unsuitable for beginners. If you’re looking for an enterprise-grade quant infrastructure, QuantConnect is a strong choice. But if you prefer a no-code trading bot, simpler alternatives might be a better fit.