Best Indicators in Automated Trading

Before getting started, the first thing to remember is that risk management is the most critical factor in determining the level of success any trading strategy may achieve. To sum up these risks, you should try not to let your feelings affect your trading decisions. Both fear and anxiety, as well as euphoria and overconfidence, may put you at risk of making errors that can put your funds and your ability to continue trading at risk. The best way to get around this problem is to install a trading bot that can run completely automated trading strategies.

1. Moving Averages

The market’s most commonly used kind of technical indicator is known as a moving average (MA). They are called “lagging indicators” because they help make predictions based on information from the past.

Due to how often they are used, they are the basis for most technical indicators, such as Bollinger Bands, Envelopes, the Average Directional Movement Index (ADX), and the Moving Average Convergence/Divergence (MACD).

The Moving Average is primarily a trend-based indicator that may be broken down into two primary subtypes: the Exponential Moving Average (EMA) and the Simple Moving Average (SMA).

Reading the moving average is a technique that is not too complicated. When a 21-day moving average is lower than an asset’s price, it indicates that the price is higher than the general average over the previous 21 days.

In the same way, if the price is higher than the moving average, it means that the price is now lower than the average price for the whole market.

One of the most common applications of moving averages in automated trading is the combination of longer and shorter time frames. When employing indicators in robot trading, another approach to using them is to start or stop a trade whenever an asset crosses a certain moving average. This may be done automatically.

In this case, a trading robot might send a buy signal when a 21-day exponential moving average (EMA) crosses above a 50-day EMA in a bullish direction.

2. Relative Strength Index (RSI)

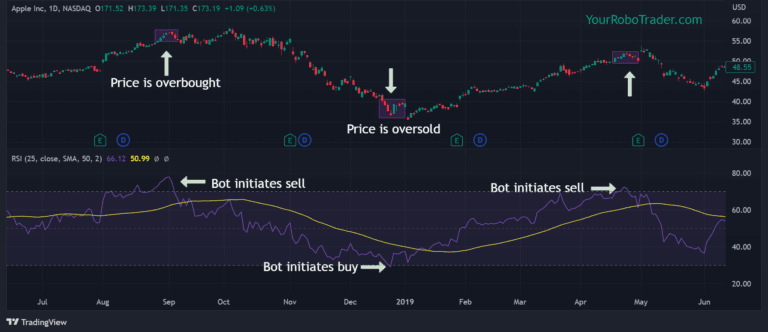

Another common indicator that is used in the process of developing trading robots is the relative strength index (RSI). As an oscillator, this instrument determines how strongly a price trend is moving in one direction or another. In general, low values lead to oversold circumstances, which provide ideal buying opportunities, while high values speak to the possibility of a trend reversal, which indicates selling the asset.

Also, the Relative Strength Index (RSI) may indicate that an asset has been overbought or oversold for a long time when it has been trading in a continuous trend, either up or down. In circumstances like these, it is important to keep in mind that the trend is your friend and that the optimal trading strategy involves following the trend in a non-active manner in order to extract the most profit from it.

The Relative Strength Index (RSI) is a common indicator that algorithmic traders use to figure out when to buy and when to get out of a trade. In an ideal scenario, a buy signal would be generated when the price moved below the oversold level of 30, and a sell signal would be sent when the RSI moved above 70. When the RSI falls below 10, which is the point at which an asset is considered to be very oversold, it’s usually a good time to buy.

So, a robot developer could just put in the order to buy when the price is oversold and sell when it is overbought.

Even the best trading indicators have some flaws. Still, by combining the signals from Moving Averages and RSI, it is possible to make automated trading strategies that have a good chance of making a lot of money in the long run.

3. Moving Average Convergence and Divergence (MACD)

The Moving Average Convergence and Divergence (MACD) indicator is a popular choice among people who make trading bots. As the name indicates, the indicator only takes the difference between the longer and shorter MAs. As a result, it may act as a trend-following indicator and a momentum indicator.

This indicator’s job is to determine where long-term and short-term moving averages meet or split apart.

One of the most common ways to use the MACD is to pay attention to the point where the two lines cross. In an ideal situation, a buy signal would be given when the two lines crossed below the neutral line.

The formation of a bearish crossover above the neutral line triggers the formation of a sell signal.

Another common trading approach, especially when used to spot divergence. To begin, the term “divergence” describes a scenario in which the price of a currency pair or stock increases while the MACD goes upwards and vice versa. This is a common way for traders to figure out if an item’s price is about to change in the opposite direction.

For instance, if the price of an asset is going up while the MACD is going down, this may indicate that the momentum is starting to wane and that the price will turn around.

In Conclusion

Trading will likely become more automated and dependent on robots in the near future. The main idea behind this is that there is no such thing as a perfect trading indicator. However, knowing the pros and cons of each trading instrument is the best way to use them in a profitable trading strategy.

You can construct the ideal trading bot using technical indicators by combining three indicators, such as moving averages, MACD, and the relative strength index (RSI). The signals that your automatic trading method gives you will be better if you use all of these indicators together.

To be fair, not everyone is capable of building a trading bot that is both good and efficient. If you are just getting started, you absolutely need to have solid programming and trading expertise under your belt. If you lack these talents, your best bet is to have a professional create the perfect trading bot for you.

If you want the perfect trading bot that suits you, you can trust us to create one for you. YourRoboTrader has a lot of experience in this field. One of the things we do best is programming services, and we are a leader in making automated trading systems. You just give the programming to our experienced professionals and then sit back and watch as your automated trading system makes trades for you. If you do not have the necessary expertise, starting automatic trading using this method would be the easiest way to get started.

The reality of the situation is that becoming successful in trading requires a lot of time, effort, and research. All of that can be avoided if you use our automatic trading bot, which will trade for you.