In algorithmic trading, your strategy is only as good as your broker’s infrastructure. You may have perfect code, but if your broker has latency, slippage, or poor API integration, your edge evaporates.

StriveFX has entered the market with a focus on technology and speed, positioning itself as a destination for traders who rely on automation, cBots, and ECN execution.

Understanding StriveFX

The retail trading landscape is shifting. Traders are moving away from manual “point-and-click” execution on clunky platforms toward automated systems, sophisticated risk management, and multi-asset diversification.

StriveFX understands this shift. Rather than offering a generic service, they have built an environment for execution efficiency. This matters for traders because StriveFX prioritizes what algos need most: low latency and raw data feeds.

What is StriveFX?

StriveFX is a global, multi-asset CFD broker operating on an ECN (Electronic Communication Network) model.

Unlike “Market Maker” (B-Book) brokers that may profit from your losses, StriveFX acts as a bridge. They route your orders directly to top-tier liquidity providers. This ensures that:

- No Conflict of Interest: They don’t trade against you.

- Accurate Market Pricing: You get the raw price from the interbank market.

- Scalability: Their servers are built to handle the high-frequency volume often generated by trading robots.

Who should use StriveFX?

While StriveFX is open to beginners, its infrastructure is over-engineered for the average casual trader. It is best for:

- Algorithmic Traders (The Core Audience): Specifically, those using cTrader Automate. If you code in C#, StriveFX is a native environment for your bots.

- Scalpers: The Professional Account offers 0.0-pip spreads, which are essential for strategies targeting small moves (1-5 pips).

- Multi-Asset Diversifiers: Traders who want to run correlations between Forex, Crypto, and Bonds in a single account.

- High-Volume Traders: ECN execution ensures large order sizes are filled without the re-quotes common in smaller brokerages.

Features & Benefits: The Algo Edge

For automated traders, StriveFX offers advantages that separate it from standard retail brokers.

Broad market access

Traders can access more than 10,000 instruments from a single account. The product range covers forex pairs, global indices, commodities, precious and base metals, bonds, and major cryptocurrencies.

Execution speed

Orders are handled through an ECN setup that StriveFX says executes in milliseconds. The goal is to limit slippage and improve order accuracy in fast-moving markets.

Modern trading platforms

The company supports both Match-Trader and cTrader. Each platform includes advanced charting, over 100 indicators, customizable layouts, and tools for algorithmic or automated strategies.

24-hour multilingual support

Customer service is available daily through live chat, email, or phone. The site lists coverage in multiple languages to match different regions.

Fund segregation and basic safeguards

Client funds are held in segregated accounts, separate from company operating capital. Negative balance protection applies to all accounts, so traders cannot lose more than their deposits.

Learning and market resources

StriveFX hosts tutorials, written guides, and daily market analysis. It also provides an integrated economic calendar and live order-book data in its trading platforms.

How to trade with StriveFX

- Registration: Sign up on the StriveFX website (approx. 2 minutes).

- Verification (KYC): Upload ID and Proof of Address. This is mandatory for AML compliance and ensures the safety of the trading ecosystem.

- Choose Account: Traders can select from four main account types:

- Standard Account

- Professional Account

- Islamic Account

- Demo Account

- Fund Your Account

You can open a Standard or Islamic account with just $10, making it easy to get

started. Your funds are kept in separate accounts for added security.

- Trade on Advanced Platforms

You can choose the Match-Trader platform or the advanced cTrader platform. Both

support automated trading and come with a complete set of charting tools.

- Withdraw Profits

StriveFX offers several withdrawal methods and Negative Balance Protection

protects your funds.

StriveFX Account Types

StriveFX offers a simplified account structure designed for users of different experience levels. Unlike complex tier systems, they offer three main variations based on deposit size and cost structure.

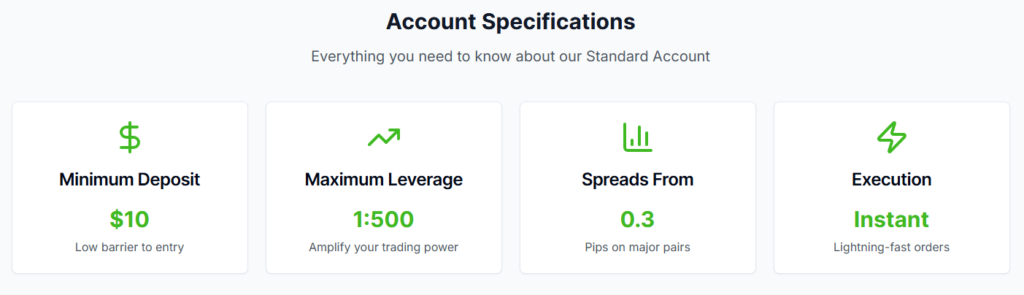

1. Standard Account

Designed for beginners and casual traders who prefer simplicity over raw spreads.

- Minimum Deposit: $10

- Spreads: From 0.3 pips

- Commission: $0 (Commission-Free)

- Leverage: Up to 1:500

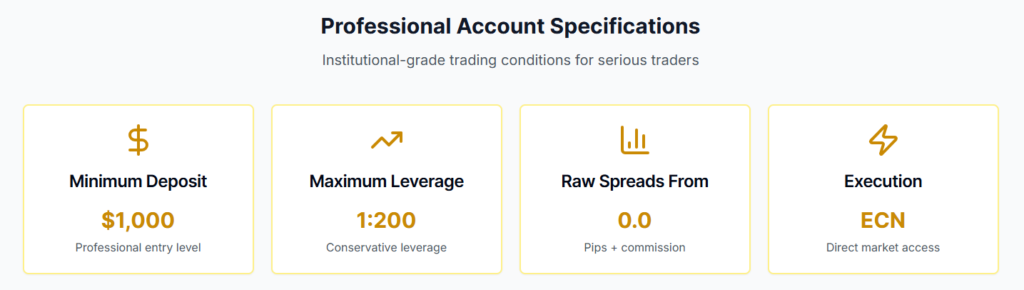

2. Professional Account

This is the flagship offering for serious traders, scalpers, and algo-developers.

- Minimum Deposit: $1,000

- Spreads: Raw from 0.0 pips

- Commission: $7 per lot (Round Turn)

- Leverage: Up to 1:200

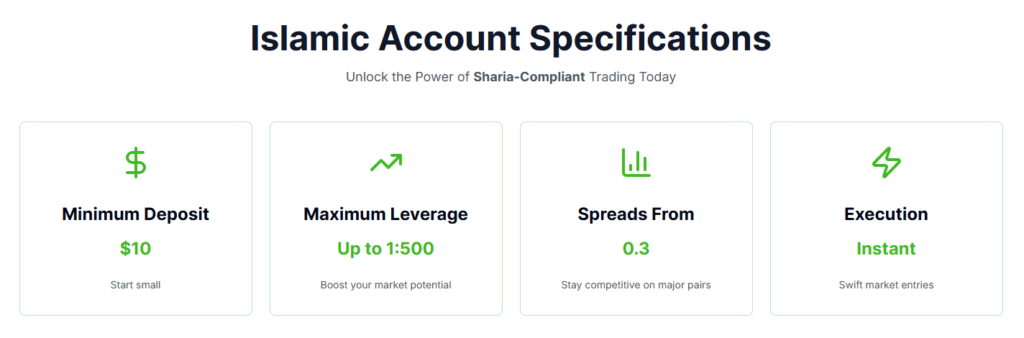

3. Islamic Account

A swap-free option for traders adhering to Sharia principles.

- Swap Fees: $0 (for the first 5 days)

- Admin Fee: Applied after day 5

- Conditions: Mirrors the Standard account execution.

4. Demo Account

A completely risk-free environment designed for strategy testing, algorithm back-testing, and platform familiarization without financial commitment.

- Virtual Balance: $100,000 (Reloadable)

- Conditions: Mirrors live market execution and spreads

- Availability: Unlimited access on both cTrader and Match-Trader

- Cost: 100% Free

The Tech Stack: Which Platform is For You?

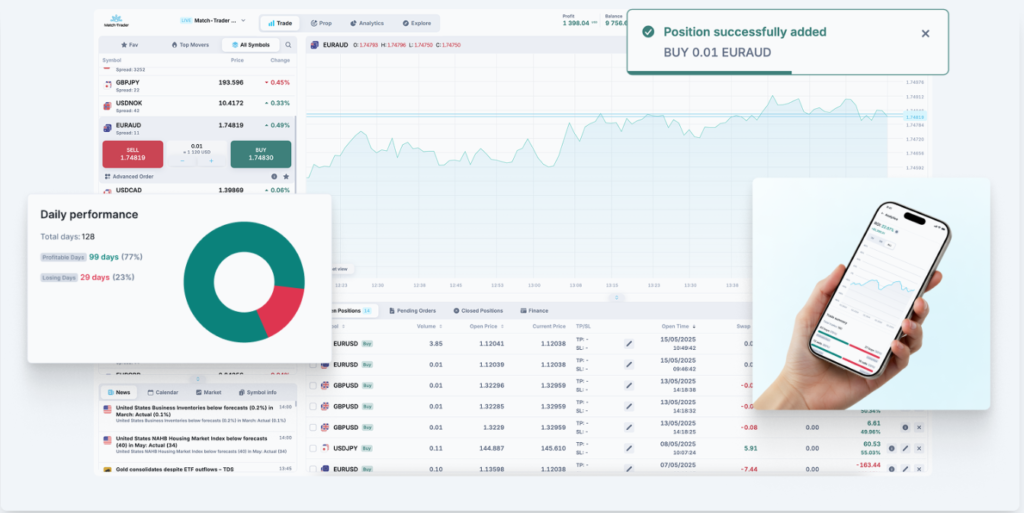

StriveFX provides two strong platforms to suit different trading styles. Instead of a single solution, they focus on matching each trader with the right tool.

- Match-Trader (Best for Accessibility)

Match-Trader is built for traders who need a platform that is fast, flexible, and synced across all devices. It combines a lightweight, user-friendly design with features like EA support and social trading. For those managing multi-asset portfolios, the desktop version offers customizable layouts and multi-monitor support, giving you the professional workspace needed for algorithmic success without the complexity of older platforms.

- cTrader (Best for Advanced Analysis)

cTrader is the gold standard for professional technical analysis and automated trading. It empowers serious traders with over 70 indicators, 67 timeframes, and full Depth of Market visibility, making it invaluable for scalpers seeking transparency. Its standout feature, cTrader Automate, enables robust C# bot development and backtesting. Whether used on desktop or mobile, cTrader offers a sophisticated, data-driven environment for those who treat trading as a science.

Market Coverage:

A 10,000+ Instrument Ecosystem: StriveFX provides a sandbox for portfolio diversification, offering ECN execution on over 10,000 instruments across six major asset classes.

- Forex: Trade 70+ currency pairs with institutional-grade conditions. Enjoy spreads from 0.3 pips, leverage up to 1:500, and complete order-book visibility for deeper analysis.

- Indices: Access global benchmarks like the S&P 500 and DAX 30 with extended trading hours. Whether trading cash or futures, you benefit from spreads as low as 0.4 points and tools to track volatility.

- Commodities & Metals: From gold and oil to coffee and corn, StriveFX offers access to a wide range of hard assets. Traders can use seasonality charts, forward curve visualization, and LBMA/COMEX pricing to navigate supply and demand cycles.

- Cryptocurrency: Capitalize on digital assets 24/7. Trade majors like Bitcoin, Ethereum, and Solana with deep liquidity and dynamic margin adjustments that adapt to volatility.

- Bonds: A rarity in retail brokerage, StriveFX offers government and corporate debt (US Treasuries, German Bunds), with yield-curve displays for interest rate hedging.

Regulation & Security: A Fortified Trading Environment

StriveFX operates under the supervision of the Comoros Financial Services Authority (License L15978/SFX) and employs a multi-layered approach to client safety.

- Financial Protection: Your capital is held in segregated accounts, distinct from the company’s operating funds. This is reinforced by Negative Balance Protection, ensuring you never lose more than your deposit, even during extreme market volatility.

- Data & Compliance: StriveFX adheres to strict PCI DSS standards, utilizing advanced encryption and regular penetration testing to safeguard your data.

- Transparency: The broker commits to fair practices through independent third-party audits and transparent, upfront pricing with no hidden fees, ensuring a secure trading ecosystem.

Market Insights & Education

StriveFX empowers traders with educational resources and analytical tools designed to demystify the markets.

- Real-Time Intelligence: Make informed decisions with live quotes, order-book visibility, and an integrated economic calendar.

- Educational Hub: Master the platforms and markets through guides, strategy tutorials, and live webinar sessions.

- Strategy Lab: Perfect your edge using advanced back-testing tools and a demo account for risk-free practice.

- Daily Updates: Stay ahead of volatility with market summaries and major event trackers.

Final Verdict

StriveFX is a “Tech-First” broker. They have stripped away the marketing fluff and focused on what matters to profitable traders: Execution, Spreads, and Platform Stability.

If you are running automated strategies, especially if you develop in C# or use cTrader, StriveFX offers a superior environment compared to legacy brokers. The combination of raw ECN spreads and high leverage provides the edge robots need to perform at their peak.

Pros:

- Excellent cTrader Automate integration.

- True ECN liquidity (0.0 pips).

- Massive asset list (10,000+).

Cons:

- High minimum deposit ($1,000) for the Pro account.