Introduction

Are you interested in implementing triangular arbitrage bots to maximize your trading profits? looking to take your trading strategy to the next level and capitalize on the ever-changing cryptocurrency market? Triangular arbitrage bots can be a powerful tool to help you maximize your trading profits by leveraging price differences between different cryptocurrency pairs.

In this guide, we will walk you through a simplified and easy-to-understand process of implementing triangular arbitrage bots in 2023. Whether you are an experienced trader or just starting out, this step-by-step approach will equip you with the knowledge and skills needed to effectively leverage triangular arbitrage and stay ahead of the competition. Learn how to effectively implement triangular arbitrage bots in 2023 and take advantage of price discrepancies in the cryptocurrency market.

Benefits of Triangular Arbitrage Bots

Triangular arbitrage bots offer numerous benefits such as capitalizing on price differences, increasing efficiency and speed, mitigating risks, and providing 24/7 market monitoring, and scalability. By leveraging these bots, you can optimize your trading strategy, save time, and potentially increase your overall profitability in the cryptocurrency market.

Navigating the Challenges

When it comes to implementing triangular arbitrage bots, many traders face common pitfalls that can restrict their success. Understanding these challenges and finding the right solution is key to standing out in the market. Let’s explore some of these challenges and how YourRoboTrader’s Triangular Arbitrage Bot can provide a unique and effective solution.

Technical Expertise

YourRoboTrader’s Triangular Arbitrage Bot eliminates this challenge by offering a user-friendly interface that requires no coding experience. You can easily set up and configure the bot without the need for complex technical knowledge.

Market Analysis

Successful triangular arbitrage relies on accurate and timely market analysis. Identifying profitable triangular arbitrage opportunities requires monitoring multiple exchanges simultaneously and analyzing price differentials. YourRoboTrader’s bot incorporates advanced algorithms that scan the market in real-time, identifying potential arbitrage opportunities across various trading pairs and exchanges.

Risk Management

Managing risks is crucial in any trading strategy, including triangular arbitrage. Failing to implement effective risk management measures can result in significant losses. YourRoboTrader’s Triangular Arbitrage Bot includes robust risk management features that allow you to set stop-loss levels, define maximum trade sizes, and apply other risk parameters to protect your capital.

Technical Support

Traders often struggle to find reliable technical support when facing issues or seeking guidance with their triangular arbitrage bots. The YourRoboTrader team is available to address any queries, provide guidance on bot setup and optimization, and offer timely solutions to ensure a smooth trading experience.

Customization and Flexibility

Every trader has unique requirements and trading preferences. YourRoboTrader’s Triangular Arbitrage Bot offers extensive customization options, allowing you to tailor the bot according to your specific trading parameters. You can define the trading pairs, adjust risk management settings, and fine-tune the bot’s behavior to align with your trading strategy. This level of customization empowers you to implement a bot that fits your individual needs and trading style.

Gain an Edge with "Your Robo Trader"

YourRoboTrader’s Crypto Triangular Arbitrage Bot goes above and beyond to provide you with a competitive advantage in the market. Let’s delve into the exceptional features that set it apart from other solutions and address the challenges faced by traders when implementing triangular arbitrage bots.

Fast Execution

Time is of the essence in the cryptocurrency market. YourRoboTrader’s bot excels in speed, swiftly analyzing price differences across multiple exchanges and executing trades within seconds.

24/7 Trading

The cryptocurrency market never sleeps, and neither should your trading bot. YourRoboTrader’s bot operates around the clock, allowing you to take advantage of price discrepancies that may occur at any time.

Reduced Risk

Managing risk is vital in any trading strategy. YourRoboTrader’s bot minimizes the risk associated with triangular arbitrage by simultaneously monitoring multiple exchanges. By scanning the market for price differences in real-time, the bot reduces the likelihood of missing out on lucrative trades and helps you maintain a balanced risk-reward ratio.

Automated Trading

Say goodbye to constantly monitoring the market and manually executing trades. YourRoboTrader’s bot automates the trading process for you. Once configured with your preferred parameters, it can independently identify profitable opportunities and execute trades on your behalf.

YourRoboTrader offers advanced algorithmic strategies, fast action, real-time data analysis capabilities, automated trading, robust risk management features, and comprehensive monitoring tools. These features and benefits address the challenges faced by traders when implementing triangular arbitrage bots, empowering them to gain an edge in the market and maximize their profitability.

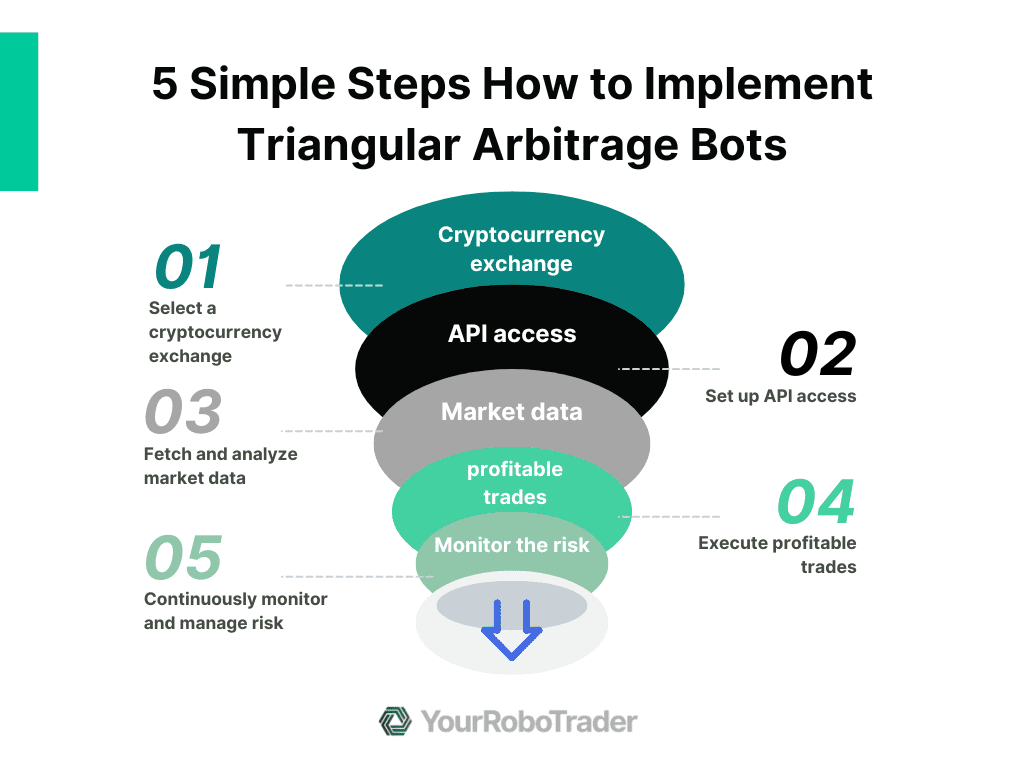

5 Simple Steps How to Implement Triangular Arbitrage Bots

Step 1: Select a cryptocurrency exchange

choosing a reliable and suitable cryptocurrency exchange is important especially to safeguard your funds, ensure a smooth trading experience, and reduce the risk of fraudulent activities. Careful research and consideration of factors are needed. When implementing triangular arbitrage bots, here are other key factors to consider:

Liquidity

Select an exchange with high liquidity to ensure smooth trade execution without significant price fluctuations.

API Capabilities

Look for an exchange with a reliable and well-documented API that enables seamless communication between the bot and the exchange.

Security

Prioritize exchanges with strong security measures, such as 2FA, cold storage, and regular security audits, to safeguard your funds and data.

Compatible Trading Pairs

Ensure the exchange offers a wide range of trading pairs involving the cryptocurrencies you intend to trade for more arbitrage opportunities.

Reputation

Research the exchange’s history and user reviews to choose a reputable platform with a proven track record.

Step 2: Set up API access

To set up API access and establish a secure connection with YourRoboTrader on your chosen cryptocurrency exchange, follow these simplified steps:

- Create an account on your preferred cryptocurrency exchange.

- Find the API settings or API management section.

- Generate API keys consisting of a public key (API key) and a private key (API secret).

- Configure API permissions by granting only the necessary actions for the bot.

- Store your API keys securely.

- Access the bot’s interface or settings and enter the API key and API secret.

- Test the connection to ensure successful communication between the bot and the exchange.

- Start using YourRoboTrader to automate your trading strategies.

Remember to refer to the specific instructions provided by the bot and the exchange’s API documentation for a smooth setup process. Monitor the bot’s activities and adjust settings as needed to align with your trading goals and risk tolerance.

Step 3: Fetch and analyze market data

To fetch real-time market data for the relevant currency pairs, YourRoboTrader utilizes APIs provided by the cryptocurrency exchange. These APIs allow the bot to access up-to-date information on prices, trading volumes, and recent trades. By staying connected to the exchange’s API, the bot can continuously monitor the market conditions and make informed trading decisions.

By combining real-time market data, bid-ask spread analysis, order book depth, and historical trade data, YourRoboTrader aims to make well-informed trading decisions. These advanced data analysis capabilities enable the bot to identify potentially profitable trading opportunities, manage risks effectively, and optimize trading strategies.

Step 4: Execute profitable trades

Once YourRoboTrader has fetched and analyzed the market data, it employs its preprogrammed trading strategies to execute trades. These strategies are based on predetermined parameters, which can include factors such as target profit margins, risk tolerance levels, and market conditions.

Trade execution by the bot is precise and automated, ensuring that orders are placed swiftly and accurately at the desired prices. This helps minimize the risk of missing out on profitable opportunities due to delays or human error.

When the bot identifies an arbitrage opportunity, which is a price difference between different exchanges or trading pairs, it swiftly executes trades to take advantage of the price difference. For example, if a cryptocurrency is priced lower on one exchange compared to another, the bot can execute a buy order on the lower-priced exchange and a sell order on the higher-priced exchange to profit from the price differential.

Step 5: Continuously monitor and manage risk

To ensure responsible trading, YourRoboTrader incorporates essential risk management features. These features help protect your investments and minimize potential losses:

Setting Stop-Loss Orders

YourRoboTrader allows you to set stop-loss orders, which automatically trigger a sell order if the price of a cryptocurrency reaches a specified level. By implementing stop-loss orders, you can limit potential losses by selling a position before it incurs further decline in value.

Monitoring Exposure

The bot monitors your exposure to different cryptocurrencies and trading pairs. It keeps track of the allocation of your funds across various assets, ensuring that you maintain a balanced and diversified portfolio.

Adjusting Trading Parameters

YourRoboTrader enables you to adjust trading parameters according to your risk tolerance and market conditions. These parameters can include factors such as trade size, profit targets, and maximum acceptable loss thresholds.

It’s important to note that while YourRoboTrader provides risk management features, it’s still crucial to regularly review and adjust the bot’s settings based on your evolving risk profile and market conditions.

Limitations of Triangular Arbitrage Bots You Need to Look

Latency and Execution Speed

Triangular arbitrage relies on exploiting price discrepancies that occur momentarily. Bots need to execute trades swiftly to take advantage of these opportunities.

Market Liquidity

Triangular arbitrage requires sufficient liquidity across multiple exchanges or trading pairs. If the market lacks liquidity, it can be challenging for the bot to execute trades promptly, and the price discrepancies may be small or non-existent.

Transaction Costs

Trading on multiple exchanges incurs transaction fees, which can eat into the potential profits from triangular arbitrage. Additionally, exchanges may have different fee structures, spreads, or withdrawal charges that can impact the overall profitability of the bot.

Technical Glitches and Downtime

Bots are susceptible to technical glitches, downtime, or connectivity issues. These issues can disrupt the bot’s trading activities and prevent it from executing trades at the desired times or prices.

Regulatory and Compliance Factors

Cryptocurrency regulations and compliance requirements vary across jurisdictions. Certain trading strategies, including triangular arbitrage, may have legal restrictions or be subject to specific regulations.

Market Risks

Triangular arbitrage strategies carry inherent market risks. Price movements, market volatility, and unforeseen events can impact the profitability of the bot’s trades.

Strategy Effectiveness

While triangular arbitrage can be profitable under certain market conditions, its effectiveness may vary over time.

Conclusion

In conclusion, this guide has provided you with a step-by-step approach to implementing triangular arbitrage bots for maximizing your trading profits in the cryptocurrency market. Start from choosing the right bot, setting up exchange accounts and API keys, configuring bot parameters, and monitoring and managing risk. Regularly review and optimize the bot’s settings to adapt to evolving market conditions.

Implementing triangular arbitrage bots can significantly enhance your trading strategy and profitability in the cryptocurrency market. Consider exploring YourRoboTrader’s Triangular Arbitrage Bot as a reliable option for successful implementation. Visit YourRoboTrader.com to learn more.

Its user-friendly interface, advanced market analysis capabilities, robust risk management features, reliable technical support, and customization options provide you with the tools and support needed to succeed in your trading endeavors. Stay ahead of the competition and maximize your profits with YourRoboTrader’s Triangular Arbitrage Bot.