Futures trading can be complex, but the right tools make it manageable and profitable. Trading bots have emerged as a reliable solution, automating strategies, minimizing emotional decisions, and operating around the clock. Whether you’re new to trading or refining advanced techniques, these bots provide the edge you need in today’s competitive markets.

This guide explores the best futures trading bots of 2025. We’ll break down their features, strengths, and drawbacks to help you find a bot that aligns with your goals. Let’s get started!

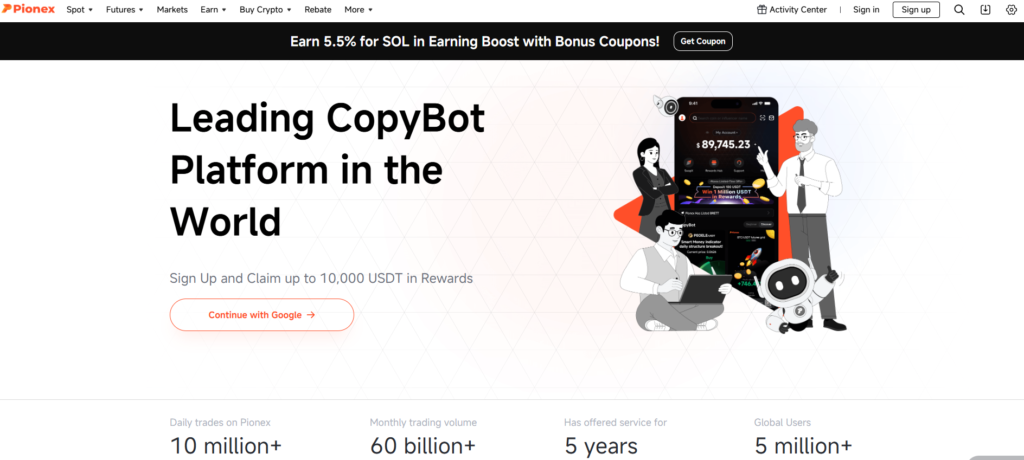

1. Pionex

Pionex is both a cryptocurrency exchange and a trading bot provider. It offers automated trading solutions that let users execute strategies without constant monitoring. With 12+ free trading bots, Pionex is a great choice for users with limited capital looking for affordable automation.

Features

- 16 different trading bots for diverse strategies.

- Spot-Futures Arbitrage bot offering up to 41.6% APR.

- Two types of Grid Trading Bots: “Use AI Strategy” and “Set Myself.”

- DCA Trading Bot for periodic investments.

- Competitive trading fees: 0.05% for spot trades and 0.1% for leveraged trades.

- Secure platform aggregated from Binance and Huobi.

- Interactive mobile app for Android and iOS with excellent user experience.

Pros of Pionex

- Free trading bots are beginner-friendly and cost-effective.

- Offers multiple bot types for various trading strategies.

- Low trading fees compared to major platforms.

- Spot-Futures Arbitrage bot minimizes risk for aggressive traders.

- Robust security measures, including U.S. FinCEN’s MSB License.

- High-quality mobile app for seamless trading and monitoring.

Cons of Pionex

- Requires careful market understanding for Grid Trading.

- Limited educational content for beginner traders.

- Withdrawal fees can vary based on the asset.

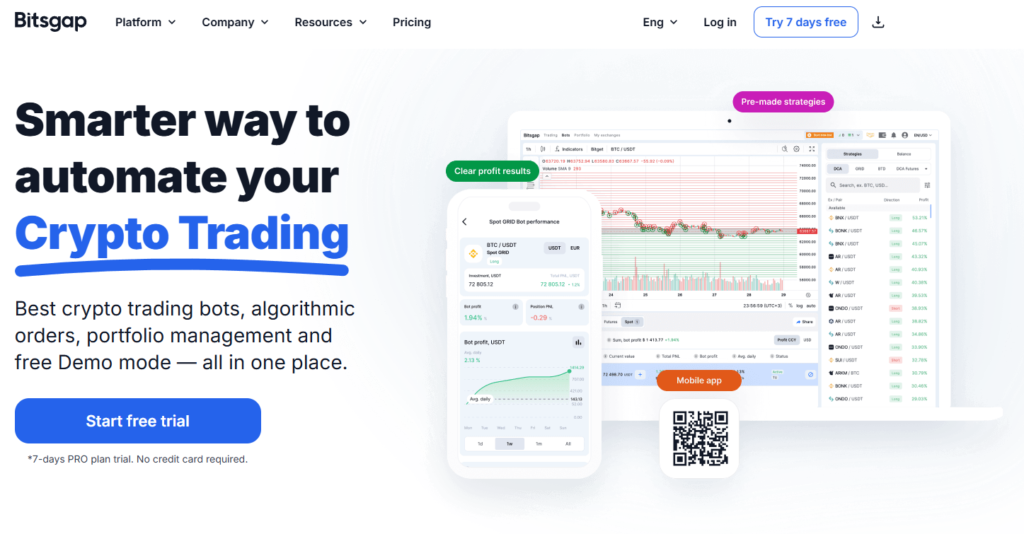

2. Bitsgap

Bitsgap is a platform that offers trading bots to automate your trading strategies. It supports over 25 popular exchanges, including Binance, Coinbase, Kraken, and Bitfinex. The platform also provides a demo mode to let users test bots before trading with real money.

Features

- Futures trading bot with automated GRID and DCA strategies.

- GRID trading bot to optimize profits by calculating per-grid returns.

- Backtesting feature to simulate bot performance in past markets.

- Crypto signals for recognizing price movements.

- 14-day free trial with multiple subscription plans for long-term use.

- API-based connection to ensure funds remain secure on your exchange.

Pros of Bitsgap

- Supports 25+ trading platforms, including major exchanges.

- Offers a demo mode for risk-free bot testing.

- Futures bot performs well in both rising and falling markets.

- Backtesting helps fine-tune strategies before deployment.

- Secure API integration without withdrawal permissions.

Cons of Bitsgap

- Futures bot is limited to Binance as of June 2021.

- No mobile app is available for on-the-go access.

- Signals lack configurable price movement alerts.

- Requires a subscription after the free trial ends.

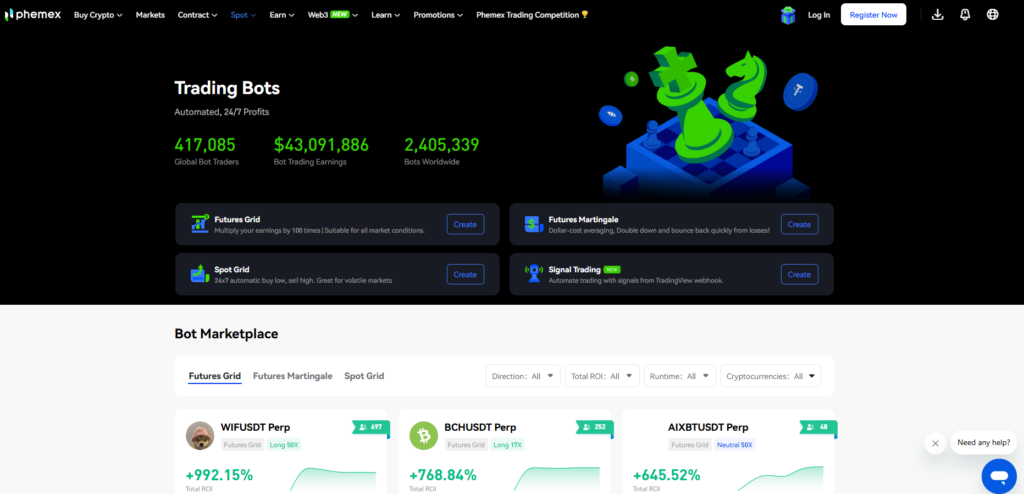

3. Phemex

Phemex, a top-tier cryptocurrency exchange, offers AI-powered trading bots tailored for beginners. Its futures trading bots automate buy and sell orders based on preset prices, making trading efficient and less time-consuming. The platform supports three unique strategies to adapt to market trends and ensure flexibility.

Features

- Free-to-use futures grid trading bot.

- Automated trading for futures contracts with spot contract support coming soon.

- Supports three distinct trading strategies for market adaptability.

- xPT pre-mining event allows users to earn xPT airdrops through trading volume.

- Mobile app for seamless trading and bot management.

- Proof of Reserves tool to verify asset security.

- Innovative cold wallet system for enhanced fund safety.

Pros of Phemex

- Free futures grid trading bot accessible to all users.

- Beginner-friendly interface and strategies for easy adoption.

- Mobile app supports automated trading and monitoring.

- xPT airdrop opportunity during pre-mining event.

- Advanced security features like cold wallets and Proof of Reserves.

Cons of Phemex

- Spot contract support for grid trading bots is not yet available.

- Advanced features might require learning for complete utilization.

- Limited information on strategy customization for seasoned traders.

4. 3Commas

3Commas is a Miami-based platform offering trading bots to automate trading strategies. It enables users to create or follow pre-set trading strategies, making it suitable for both beginners and experienced traders. By using API keys, 3Commas ensures secure integration with your trading platform without granting withdrawal rights.

Features

- GRID Bot: Automates buying low and selling high based on your chosen price range.

- DCA Bot: Allows regular, automated investments to average the buy price.

- Options Bot: Facilitates trading of call and put options for bullish or bearish strategies.

- Copy Trading Bot: Enables copying of pre-configured bot settings with options to adjust parameters.

- Subscription Plans: Four plans available – Free, Starter, Advanced, and Pro, with discounts for long-term subscriptions.

Pros of 3Commas

- Multiple bot types to suit varied trading strategies.

- Copy Trading Bots simplify bot configuration for beginners.

- Subscription flexibility with monthly and yearly plans.

- Uses API keys to ensure no withdrawal access for bots.

- DCA bots help automate investments efficiently.

Cons of 3Commas

- Lack of detailed information about security protocols.

- Copy Trading requires careful fund management to avoid risks.

- Some features may have a learning curve for new traders.

5. Altrady

Altrady is a powerful trading platform offering automated tools and bots for crypto trading. It provides GRID and SIGNAL Bots, making it easy for experienced traders to maximize returns in fast-moving markets. With a wide range of features, Altrady aims to streamline trading for all styles.

Features

- Trade on multiple exchanges and exchange accounts.

- Support for multiple accounts on a single exchange.

- Real-time break-even calculations.

- Offline price and order alerts.

- Visual trade feedback displayed directly on charts.

- Integrated market scanners for better opportunities.

- Trade automation with take profit and stop loss options.

- SIGNAL Bots using TradingView webhooks or Crypto Base Scanner signals.

- GRID Bots with trailing up and down functionality.

- Portfolio management with subaccounts.

- Comprehensive trading analytics.

- Upcoming features: new mobile app, external wallet portfolio support, DEX integration, and paper trading.

Pros of Altrady

- Offers multiple tools for advanced and automated trading.

- GRID and SIGNAL Bots provide flexibility for different strategies.

- Supports multi-exchange trading and subaccount portfolio management.

- Includes advanced features like break-even calculation and market scanners.

- Continuously updated with new features like DEX integration and paper trading.

- Free 14-day trial for users to explore its functionalities.

Cons of Altrady

- Focus on advanced tools may overwhelm beginners.

- Some advanced features require learning to use effectively.

- Upcoming features like DEX integration and paper trading are not yet available.

6. WunderTrading

WunderTrading has been a trusted crypto trading bot platform since 2019, with over 121K users. It offers tools like Grid, Signal, and DCA bots for automated trading on top cryptocurrency exchanges. The platform supports multi-account management and advanced trading features for efficient and profitable trading.

Features

- Flexible order management with Take Profit, Stop Loss, and Trailing Stops.

- Futures spread trading to reduce volatility by creating spreads.

- Manage multiple exchange accounts using APIs.

- Automated portfolio tracking linked to exchange balances.

- Arbitrage trading across markets for instant profit opportunities.

- Risk-free demo trading to practice strategies.

- Affiliate program with earnings up to 50%.

Pros of WunderTrading

- Supports multiple accounts and major exchanges.

- Risk-free paper trading to learn and test strategies.

- Comprehensive trading tools, including arbitrage and spread trading.

- Free 7-day PRO Plan trial without a credit card.

- Easy-to-use platform suitable for all skill levels.

Cons of WunderTrading

- Requires familiarity with advanced tools like arbitrage and spreads.

- Dependent on supported exchanges for full functionality.

- May feel overwhelming for beginners without prior trading experience.

7. Algobot

Algobot is a futures trading bot designed for optimizing trading strategies. It offers advanced algorithms, real-time data analysis, and a user-friendly interface to automate trades, manage risks, and enhance results. Suitable for beginners and experienced traders, Algobot supports diverse trading styles and expertise levels.

Most bots support customizable strategies, such as grid trading, dollar-cost averaging (DCA), and arbitrage. They also provide features like backtesting, real-time alerts, and advanced analytics to refine performance. Futures traders who apply prop firm-style risk techniques often use these tools to mimic hedging strategies typically reserved for multi-account setups.

Features

- Automated 24/7 trading for continuous market monitoring and execution.

- Backtesting using historical data to evaluate strategy performance.

- Real-time alerts and adjustments for dynamic strategy refinement.

- Pre-set strategies for beginners and custom options for advanced traders.

- Secure API integration with trading accounts for seamless operation.

Pros of Algobot

- Operates continuously without requiring constant user input.

- Backtesting feature allows for informed strategy deployment.

- Real-time alerts ensure traders stay updated on market conditions.

- Beginner-friendly with easy-to-use tools and pre-configured strategies.

- Flexible settings for tailoring strategies to individual goals.

Cons of Algobot

- Success depends on market conditions and strategy effectiveness.

- Beginners may face a learning curve understanding advanced features.

- Historical backtesting results may not guarantee future performance.

8. Gainium

Gainium, launched in 2021, simplifies cryptocurrency trading for beginners and experienced traders. The platform offers tools to automate trading strategies, manage trades, and analyze performance with ease. With Gainium, users can transition seamlessly between manual and automated trading while leveraging a strong trading community.

Features

- Unlimited backtesting and forward testing for strategies.

- Grid, DCA, and combo bots to automate trades.

- Market screener for identifying trading opportunities.

- Simulated trading for risk-free strategy testing.

- Optimized bot configurations based on daily backtests.

- Smart trading terminal for automated and manual strategies.

- Integrated technical indicators and webhook support.

Pros of Gainium

- Beginner-friendly with no coding required.

- Unlimited backtesting for building strategies.

- Community-focused platform for collaborative learning.

- Combines grid and DCA strategies for diverse market conditions.

- Tools for real-time analysis and trade execution.

Cons of Gainium

- Requires some learning for advanced features.

- Success depends on individual strategies and market trends.

- Relies on historical data, which may not predict future outcomes.

What is Futures Trading?

Futures trading involves buying or selling a financial contract that obligates the trader to purchase or sell an asset at a predetermined price and date. These contracts are based on the value of underlying assets, such as cryptocurrencies, commodities, stocks, or indices. Futures trading allows traders to speculate on the future price movements of these assets, either for profit or to hedge against price fluctuations.

In futures trading, you don’t own the underlying asset. Instead, you trade the contract itself, making it a popular choice for those who want exposure to market movements without physically holding the asset. Leverage is often used in futures trading, allowing traders to control larger positions with smaller capital, but this also increases the risk.

By enabling both long (buy) and short (sell) positions, futures trading offers opportunities in rising and falling markets. It requires careful planning, risk management, and market understanding, which is why many traders turn to automated futures trading bots to streamline the process.

What Are Futures Trading Bots?

Futures trading bots are automated software tools designed to execute futures trading strategies on behalf of traders. These bots use predefined rules, algorithms, and real-time market data to buy and sell futures contracts, eliminating the need for constant manual monitoring.

The primary goal of a futures trading bot is to enhance efficiency and accuracy. By automating repetitive tasks, such as analyzing market trends, placing orders, and managing risks, bots allow traders to focus on strategy and decision-making. They are especially valuable for capitalizing on 24/7 markets, like cryptocurrency, where opportunities can arise at any time.

Most bots support customizable strategies, such as grid trading, dollar-cost averaging (DCA), and arbitrage. They also provide features like backtesting, real-time alerts, and advanced analytics to refine performance. Futures trading bots cater to both beginners and experienced traders, offering tools that adapt to different levels of expertise and trading goals.

Conclusion

Our review of the best futures trading bots of 2025 highlights how each platform offers distinct features tailored to various trading needs. From advanced automation tools to user-friendly interfaces, these bots empower traders to maximize their potential in the fast-evolving futures market. Here’s a summary of the top futures trading bots and their standout qualities:

- Best Overall for Versatility and Beginner Accessibility: Pionex

- Ideal for Advanced Strategies and Backtesting: Bitsgap

- Top Choice for Free Features and Security: Phemex

- Best for Comprehensive Automation and Customization: 3Commas

- Great for Community-Driven Strategy Sharing and Research: Gainium

- Best for Intuitive Features and Advanced Bot Integration: Algobot

- Outstanding for Multi-Exchange Management and Arbitrage: WunderTrading

- Top Pick for Complete Trading Toolkits and Portfolio Management: Altrady

Selecting the right futures trading bot depends on your goals, trading style, and level of expertise. Consider the tools and features that align with your specific needs to ensure a smooth and effective trading experience. With the right bot, you can unlock opportunities and refine your strategies for long-term success in futures trading.

FAQs

Are futures trading bots suitable for beginners?

Yes, many bots offer features tailored for beginners, including pre-configured strategies and intuitive interfaces. Beginners can also use demo accounts to practice without financial risk.

How much can I earn with a futures trading bot?

Earnings depend on your chosen strategy, market conditions, and risk management approach. While bots improve efficiency, they do not guarantee profits.

Do I need coding skills to use a futures trading bot?

No, most bots are designed to be user-friendly, and no coding is required. However, some platforms allow advanced users to customize their bots using code.

What features should I look for in a futures trading bot?

Key features include backtesting, real-time alerts, risk management tools like stop-loss and take-profit, and compatibility with your trading exchange. Customizable strategies are also important for flexibility.

Are futures trading bots safe to use?

Reputable bots are safe when integrated with exchanges securely using API keys without withdrawal permissions. Always enable two-factor authentication (2FA) for extra protection.

How much do futures trading bots cost?

Costs vary depending on the platform. Some offer free versions, while others charge subscriptions or commissions. Choose one that fits your budget and trading style.

Can bots trade 24/7?

Yes, bots can operate around the clock, taking advantage of opportunities in markets like cryptocurrency, which trade continuously.

Do bots work in all market conditions?

Bots follow pre-set rules and may not perform well in all market scenarios, especially during extreme volatility. Regular adjustments and monitoring are essential for consistent results.

Can I use a bot with multiple exchanges?

Many bots support multiple exchanges, allowing traders to manage accounts and execute trades across different platforms. Verify the bot’s compatibility with your preferred exchanges.