What is a Crypto Trading Bot?

Crypto trading bots are automated trading software that assists you in buying and selling cryptocurrency at the right moment. Profit maximization and risk mitigation are the primary objectives of this software. With these tools, you can manage all of your exchange accounts for cryptocurrencies from one place.

Most forex trades are made automatically, which is something everyone knows. The cryptocurrency market is merely following suit.

What Does Crypto Trading Bot Do?

Every crypto bot boils down to an algorithm that specifies a trading strategy or set of strategies. There are three main goals that crypto trading bots should achieve:

- Consider both current and past market data.

- Identify potential risks (predict price movements short and long-term)

- Use APIs provided by cryptocurrency exchanges to conduct trades as needed.

How Effective Are Crypto Trading Bots?

It all depends on several variables. Almost all trading bots promise that they can have a high success rate while still working normally. This, however, is not always the best course of action, especially if the market conditions are unfavorable. The best option is to build a bot that fits your trading habits and workflow.

Is Crypto Trading Bot Profitable?

Trading bots are only pieces of software; as a result, there is no assurance that using them will result in a profit. Assuming they are set up correctly, trading bots may be quite lucrative. You can be sure that the best cryptocurrency trading bots will make you money, so make sure to test them out before making a decision. That’s why understanding how they function is crucial.

When To Use A Crypto Trading Bot?

A well-implemented bot may do a wide variety of tasks for you, including rebalancing, portfolio management, data collection, intelligent order routing, etc.

How can automated trading help?

- Repetitive Tasks

When you do the same things over and over, you spend a lot of time and energy. With the help of a crypto trading bot, you may “copy and paste” certain tasks to make trades quickly and effortlessly. A great example of how bots could help with routine tasks is rebalancing tasks at regular intervals. Your portfolio must be rebalanced at the top of each hour for hourly rebalancing to work. Construct a trading robot and set it to rebalance your portfolio once an hour automatically.

- Timing

Trading is a field where having accurate timing is essential. If you want to sell your currency, it is in your best interest to keep a close eye on the price. In this context, the bot can watch the market and carry out a trade at the optimal moment.

- Reduced Complexity

Trading in cryptocurrencies requires meticulous pair selection based on asset liquidity and market value. It is important to finish the whole route within a certain amount of time and in line with how the market is doing at the time. If you pick your trading bot carefully, it will help you automate even the hardest and most impossible trading strategies.

Are Crypto Trading Bots Legal?

The use of trading bots is not against the law. There are some people who do have problems with how automated trading affects the markets, but there are no rules or legislation in place that prevent ordinary traders from employing trading bots.

What Are The Different Kinds Of Crypto Trading Bots?

The following is a list of the different kinds of cryptocurrency trading bots:

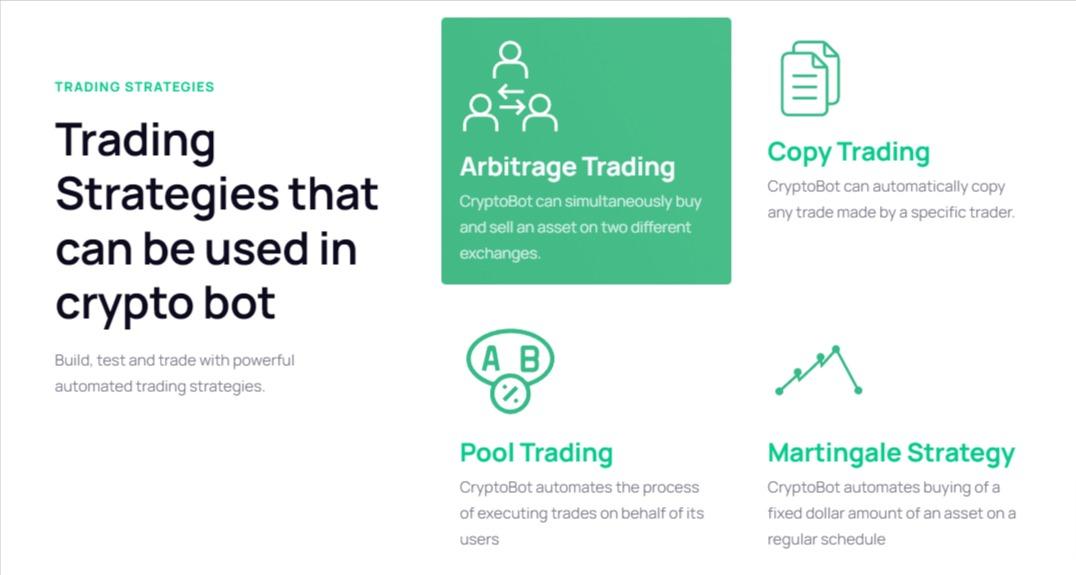

- Arbitrage: It is a method in which coins are purchased on one exchange and sold on another. If you want to generate quick and secure profits in the cryptocurrency market, this is one of the first tactics you should try.

- Market Making: The most important advantage of market making is that it enables you to avoid experiencing significant price fluctuations. Setting limit orders to purchase or sell at or around the current market price is one strategy. Many market-making bot traders are associated with their trading projects.

- Momentum trading: Often known as a trend-following technique, is a great way to profit from the upswing in asset prices during an ongoing trend. The concept here is that your asset’s price will rise beyond its long-term average, reach a ceiling, and start falling again. Buying and selling are very important under these circumstances.

- Mean Reversion: It is a form of AI crypto trading bot approach that is based on the concept that if a coin’s price deviates from its average, it may be reverted back to its average. For instance, if the price of a currency drops to 50c from its average price of $1, many traders may consider its most recent price to be affordable and buy huge quantities of it as a result.

- Copy trading: It is a popular new technique that allows you to automatically replicate the trades of successful traders. It frequently incorporates gamification aspects, such as a leaderboard, as well as a social group. You can also utilize several crypto trading bots to automatically mimic the trades of successful traders with a single click.

What Are The Advantages Of A Crypto Trading Bot?

- Considering that financial markets are closed during the night and on holidays, the phrase “crypto never sleeps” is more true. On the other hand, crypto bots keep ticking away 24/7, even on holidays, providing a boon to traders who can stomach the volatility.

- In the trading world, bots don’t act on a whim. Their lack of emotional reasoning means they are immune to the kind of unexpected gains or losses that plague humans.

- Trading robots save time and effort. Contrast the human brain’s ability to process information at a constant rate with the software’s ability to process several sources of input concurrently. Add to this the fact that trading bots do not require human interaction with their user interface and you have a recipe for success.

- Paper trading and backtesting allow for rapid simulations that would take much longer under manual trading settings. As a consequence of this, bots join the actual market with trading strategies that have been optimized and validated.

How To Select A Crypto Trading Bot?

How trustworthy is the team?

If you are going to entrust a bot with your portfolio, you need to make sure that the team that developed the bot has the highest possible level of experience and credibility. You have an obligation to make certain that the team maintains an open and honest atmosphere regarding their progress.

When it comes to automated trading, YourRoboTrader has more than 7 years of experience. One of our areas of expertise is in the provision of programming services, and we are also the industry leader in the development of automated trading systems. You may hand over the coding to our seasoned pros and sit back while your automated trading system makes all the necessary trades. Starting automated trading using this strategy would be the simplest way to get started if you lack the necessary experience.