Our mission is to empower traders worldwide with high-performance algorithms that truly work.

YourRoboTrader is a powerful solution from QuantTechnology, a leading Singapore-based fintech holding company specializing in algorithmic trading and financial innovation.

We’ve developed and tested hundreds of trading algorithms, meticulously separating the underperformers from the consistent winners.

Problems.

The vast majority of trading algorithms fall short, leaving traders frustrated and disappointed.

Solution.

We brings the power of institutional-grade algorithms to private traders for the first time.

Traditional trading can be challenging, requiring constant monitoring and potentially leading to emotional decisions. Algorithmic trading offers a sophisticated approach that:

Predefined rules guide your trades, removing fear or excitement from the equation.

Operate 24/7, capturing opportunities you might miss while sleeping or working.

Backtest your approach on historical data, ensuring it aligns with your goals and risk.

Algorithmic systems react in milliseconds, taking advantage of fleeting market movements.

YourRoboTrader, a subsidiary of QuantTechnology, empowers traders with high-performance algorithms developed and tested by a passionate team in Germany.

We’ve spent over 7 years refining our strategies to bring institutional-grade power to individual traders.

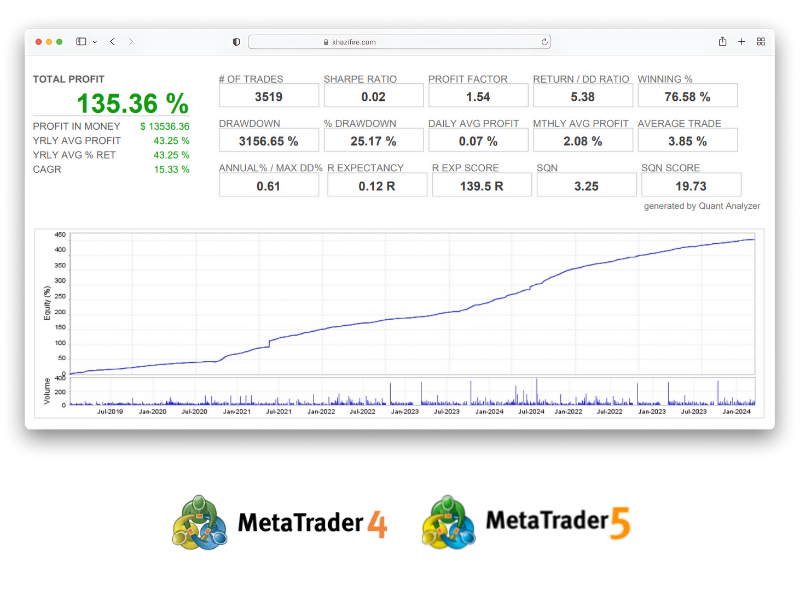

The Bar Breakout EA empowers you to capture opportunities and manage risk with dynamic trading strategies.

Benefits:

- Volatility Advantage: Scalp in high volatility, trade conservatively in low volatility.

- Measured Recovery: Mitigate losses with a controlled martingale approach.

- Automated Trading: Remove emotions and trade 24/7.

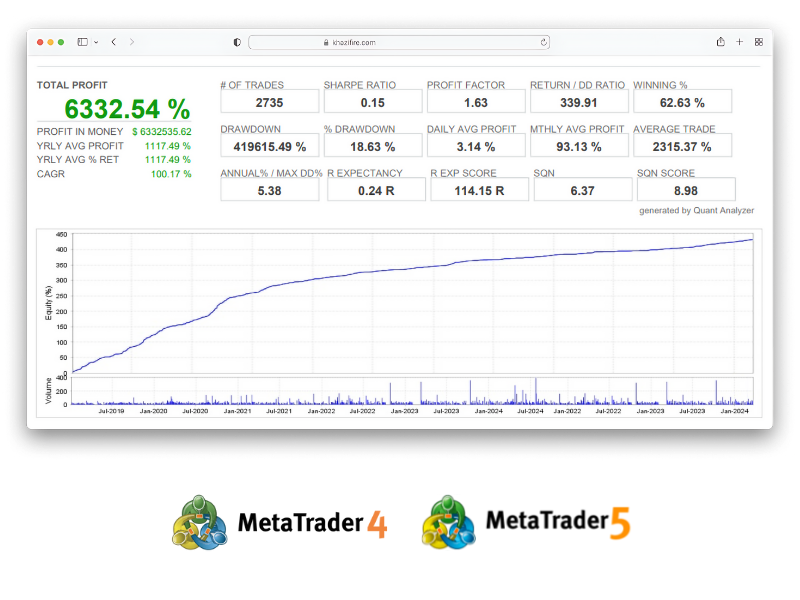

Benefits:

- Trend Precision: Enter trades only when a trend shift is confirmed for optimal entries and exits.

- Controlled Recovery: Minimize losses with a conservative martingale strategy.

- Automated Trading: Eliminate emotional decisions and trade confidently 24/7.

The Bar Breakout EA empowers you to capture opportunities and manage risk with dynamic trading strategies.

Benefits:

- Volatility Advantage: Scalp in high volatility, trade conservatively in low volatility.

- Measured Recovery: Mitigate losses with a controlled martingale approach.

- Automated Trading: Remove emotions and trade 24/7.

Only algorithms that pass this stringent 5-step process are offered to our clients.

STEP 1

Concept Development

We spark the concept and define its core principles.

STEP 2

Backtesting & Optimization

We rigorously test the strategy against history and optimize for performance.

STEP 3

Risk

Assessment

We assess the strategy’s risk profile under various market conditions.

STEP 4

Simulation

We simulate real-time trading to observe the strategy in action.

STEP 5

Live Implementation

We cautiously deploy the strategy for actual trading.

Discover how YourRoboTrader’s high-performance algorithms can help you achieve your trading goals.

Explore insights, reviews, and expert articles. Gain the knowledge and strategies to master algorithmic trading.

Golden Pickaxe Review

Pricing Golden Pickaxe offers a comprehensive package for serious traders: Lifetime License: Priced at $2160...

1000pip Climber System Review

Pricing The 1000pip Climber System is currently available at a significant discount: Lifetime License: Originally...

Waka Waka Review

Pricing Waka Waka offers a comprehensive package for serious traders: Permanent License: Priced at $2340...

Here you will find frequently asked questions about automated trading with Robotrader and our service.

Algorithmic trading involves using computer programs that follow a defined set of instructions for placing trades in order to generate profits at a speed and frequency that is impossible for a human trader. These algorithms are designed to identify profitable opportunities within financial markets and execute trades automatically.

Our algorithms are developed by experienced quant analysts and utilize sophisticated mathematical models to predict market movements and execute trades. They provide several advantages, such as reducing the impact of human emotions on trading decisions, enabling 24/7 trading, and improving the speed and accuracy of trade execution.

Yes, our algorithms are designed for a variety of traders, from beginners to seasoned professionals. We provide customizable settings that allow traders to adjust strategies according to their risk tolerance and trading goals. Our support team is also available to help you understand and set up the algorithms according to your needs.

No technical expertise is required. If you’ve navigated to our site and are reading this, you have all the skills necessary to use our trading systems. Setup is simple, and our customer support team is available to help you with any questions or issues you may encounter.

As with any trading activity, there are risks involved, and profits cannot be guaranteed. Our algorithms are designed to maximize opportunities and minimize losses, but it’s important to understand that the financial markets can be unpredictable. We recommend a diversified and well-thought-out trading strategy.

Our algorithms are designed to be fully autonomous, requiring minimal time investment from you after the initial setup. While the systems operate automatically, we advise periodically checking in to review performance and make any necessary adjustments.

Getting started is simple. Just click on the “Apply Now for a Consultation Session” button and fill out the form. One of our experts will contact you to discuss your trading goals and how our algorithms can assist you.

We offer comprehensive support, including a detailed setup guide, video tutorials, and access to our customer service team via email or chat. Our team is dedicated to helping you maximize the benefits of our trading algorithms.